An apartment lease-up refers to the time between the announced launch of a new apartment community and six to 12 months after opening.

During that time the community will build a brand, establish a website, open its doors for business, and welcome its first batch of residents.

A lease-up sets the tone for your community’s long-term success. This guide breaks down each phase—before and after opening—so you know exactly what to do and when.

We'll follow the same strategic timeline we use when helping clients navigate their lease-ups:

- Phase One: The As Soon As Possible Phase

- Phase Two: 6 Months Before Opening Day

- Phase Three: 3 Months Before Opening Day

- Phase Four: Opening Day And Beyond

With a well-defined lease-up strategy, you're doing more than just setting your new community up for immediate leasing, occupancy, and revenue growth—you're setting the property up for years of sustained success. Let's dive in!

Lease-Up Phase One: The As Soon As Possible Phase

The lease-up begins when the ink dries on the contract to construct your new apartment community. Two significant marketing undertakings take immediate priority: defining your community's identity and building its online presence.

These are often referred to as "Go-To Market" steps, or GTM, and to help, we've enlisted the expertise of Kate Rathe, Director of Complex Management for Century Sales & Management, LLC.

Choose a Name for your Apartment Community

Choosing a name for your new apartment community is tricky. In our years working in the multifamily industry, we've seen it all when it comes to names. From a marketing perspective, we've discovered that it's essential for names to be distinct, easy to spell, and easy to remember for prospective residents to find your community in an online search.

Once you've got your name final, the next step is to purchase a domain for your website. Choose a short, memorable “.com” domain that includes your apartment name if possible. Keywords like “apts,” “apartments,” or “liveat” are helpful but not required.

Here are three tips for choosing an apartment community name that achieves those goals. Watch ⬇️

Create Your Community's Logo and Color Scheme

Establish your visual identity early—logo, fonts, and primary and secondary colors. Hiring a designer is worth it.

Put Up A 'Coming Soon' Apartment Website

Launch a “Coming Soon” site early to start building trust and SEO visibility. Even without finalized content, use renderings or media from similar properties to establish credibility with search engines and future prospects.

Claim & Verify Your Community's Google Business Profile

Your Google Business Profile will be one of your most visible and central marketing channels, boosting traffic and leads to your community website.

When a prospective resident searches for your community by name, Google will display your profile prominently in both desktop and mobile search results.

This placement creates needed trust and meaningful visibility for your apartments because prospective residents recognize these listings as dependable and accurate. They utilize them to find your community in Google Maps, get directions, click your website, phone your leasing office, and read your online reviews.

Follow these steps to claim and verify your apartment community's Google Business Profile.

Lease-Up Phase Two: 6 Months Before Opening Day

Phase Two is when a lot of the heavy work begins.

The focus of this phase should be:

- Completing your apartment's website design.

- Setting rent levels for every unit that'll go live on opening day.

Though we won’t go into specific details here, this is also the appropriate time to begin the staffing process. Hiring a property manager is of utmost priority, but you'll also need to start recruiting for a leasing agent or assistant manager, weekend staff, and maintenance personnel.

Complete the Design of Your New Community Website

Though your apartment community's website is live, it still needs to be completed. Up to this point, its main goal has been to announce the launch of your new apartments. You and your developer must strategize and finalize the website's design so it's ready at least three months before you open the doors.

Here are the essentials:

- Mobile-First Design: If your website is unnecessarily difficult to use on an iPhone, doesn't load fast, or has broken pages prospects will leave quickly, and you'll have lost out on a great lead.

- Floorplan-Specific Pages: Prospective residents care most about the units they'd be living in when seeking information about an apartment community. These pages address those needs with virtual tours, photos, live pricing, availability, and amenity details.

- Virtual Tours: Your leasing office can stay open 24/7 because walkthrough video tours allow prospects to see the inside of your units without needing to drive anywhere. They also generate more qualified leads for your leasing agents by increasing the interest level for prospects looking for exactly what your apartments offer.

Setting Unit Rent Levels In A Lease-Up

Set a base rent for each floorplan by comparing against similar units in your portfolio or nearby communities. Then adjust pricing by unit based on differentiators like views, floor level, or proximity to amenities.

And don't be afraid to make adjustments, especially early in the lease-up.

Lease-Up Phase Three: 3 Months Before Opening Day

It's crunch time—you're less than three months away from having residents move into your new apartment community.

You need to start developing leads by turning on various paid marketing sources that will direct people to your community website so they can begin engaging with your leasing office.

You also need to set a regular meeting cadence with your contractor (if you still need to) to ensure that your units will be ready on time, as that affects your pre-leasing strategy.

Turn On Your Apartment Community's Digital Ads

You may have a great website with compelling photos and walkthrough video tours. However, this won't matter unless you have a method of getting prospects to come to visit it. That's why now is the time to begin driving traffic to your apartment's website through digital advertisements on Google and Facebook.

Check out RentVision's complete digital advertising guide (and bookmark it!) for everything you need to know about how to set up effective digital ad campaigns that generate qualified leads so you're fully prepared for turning on this critical lead flow during this phase of the lease-up.

How to Approach Marketing Spend During a Lease-Up

With 100% vacancy, speed matters. This is the time to spend aggressively on digital ads because every day a unit sits vacant is lost revenue you’ll never recover.

Imagine you have a 200-unit community opening, and your average rent is $1,500/month. That’s $300,000 in potential monthly revenue sitting empty on day one. If you only lease 3 units per week, it would take more than 15 months to reach full occupancy.

Now, assume you allocate $10,000/month to digital advertising. Even if that $10,000 only produces 7–8 leases per month, you're still winning. Each lease you secure accelerates your rent roll and reduces months of lost revenue—easily covering and exceeding your ad spend.

How To Handle Lease Signings Before Opening Day

You can take deposits and sign leases before your opening, as long as you have a certificate of occupancy by move-in. Just be strategic—space out expiration dates to avoid a flood of move-outs next year.

Lease-Up Phase Four: Opening Day And Beyond

Opening day is a major milestone—celebrate it. Gifts, food trucks, or ribbon cuttings are great ways to welcome new residents.

To avoid chaos, try to limit how many move-ins can occur in any single day so that new residents aren't bumping into each other while moving their couches into their apartments.

As exciting as opening day is, plenty of work remains ahead for you and your team.

How To Complete a Lease-Up Faster

To recall, your lease-up period ends when your new community has reached 95% occupancy, and tenants are paying at or above market-level rent.

The speed of your lease-up depends on two factors you have complete control over: pricing and marketing.

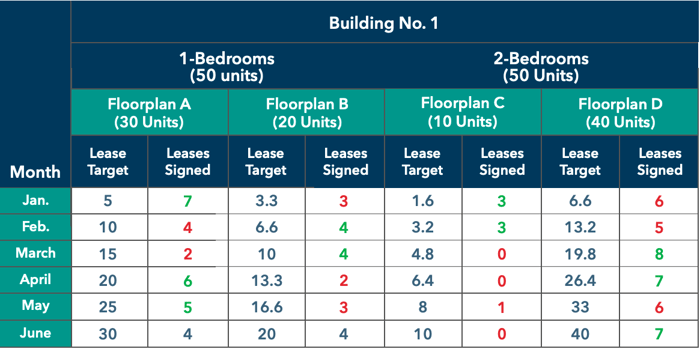

Tracking the number of leases signed compared to lease targets, as seen in the example illustration below, allows your team to record your progress as it advances and identify any pain points along the way.

Adjust Pricing Quickly

Let's look at what happens here with Floorplan A in the table above and how it relates to pricing.

After signing 11 leases in the first two months after opening, it fell below target in March. That dip signals it’s time to adjust pricing.

If demand drops, adjust rent quickly—0–5% shifts in early months can help you find the “sweet spot.” As occupancy stabilizes, smaller 0–2% tweaks are ideal to avoid pricing out prospects.

Optimize Marketing Spend Based On Leasing Velocity

You need to be just as vigilant and flexible with your marketing as you are with pricing early in the lease-up.

First, you need to consistently monitor the amount of paid and organic traffic to your apartment community's website in Google Analytics. Lower your digital ad spend to save money if you always meet or exceed your monthly lease targets.

If you fail to meet lease targets, raise your spending to drive more traffic. Like finding your pricing sweet spot, you need to find the appropriate amount of website traffic required to generate more leases faster.

Conclusion

A successful lease-up doesn’t just fill units—it accelerates revenue and lays the foundation for long-term performance. If you're planning a new development, schedule a demo. We’ll show you how predictive marketing can help you lease units fast and stay ahead of vacancy.

Case Study:

See How One Community Completed Their Lease-Up 3 Months Faster With Predictive Marketing.